(Reuters) - The Group of Seven industrial nations agreed on Friday to jointly intervene in the currency market to stem a sharp yen rise that complicates Japan's battle with the devastation caused by last week's violent earthquake and an unfolding nuclear crisis.

"Given yen moves after the tragic events that hit Japan, the United States, Britain, Canada and the European Central Bank have agreed with Japan to jointly intervene in the currency market," Finance Minister Yoshihiko Noda told reporters.

Japanese authorities will buy dollar/yen in the market from 9 a.m. (12:00 a.m. GMT). Other central banks will act when their markets open, Noda said. He declined to comment on the size of Tokyo's intervention. Click to read more.

Thursday, March 17, 2011

Yen surges to all-time high in chaotic trade

(Reuters) - The yen soared to a record high against the dollar on Thursday in chaotic trading as a break of the previous peak triggered a host of stop-loss and option-related selling, which in turn caused a cascade of algorithmic sales.

While the escalating nuclear crisis and subsequent rush for safety was the initial spur for the move, this latest lunge higher in the yen was more about positioning.

All sorts of exotic option and structured products were being stopped-out, while many Japanese margin traders were forced to bail from leveraged trades funded in yen.

Dealers said the market was increasingly disorderly with liquidity evaporating and bids pulled, leaving huge gaps in the charts. Many were actively hoping the Japanese authorities would intervene to provide some liquidity and restore order. Click to read more.

While the escalating nuclear crisis and subsequent rush for safety was the initial spur for the move, this latest lunge higher in the yen was more about positioning.

All sorts of exotic option and structured products were being stopped-out, while many Japanese margin traders were forced to bail from leveraged trades funded in yen.

Dealers said the market was increasingly disorderly with liquidity evaporating and bids pulled, leaving huge gaps in the charts. Many were actively hoping the Japanese authorities would intervene to provide some liquidity and restore order. Click to read more.

Thursday, March 10, 2011

Comparison of My First Home Scheme and Subprime

There are a new "My First Home Scheme" launched recently. Analysts were mixed on whether the first-home ownership scheme would risk creating sub-prime conditions.

Well, I just created a comparison table for the both and you be the judge! Click on the picture to enlarge. The general description should give you all some ideas. For better understanding, more in-depth research is encouraged.

Tuesday, March 8, 2011

Beware of cheater asking for bank account information!

Well, I am sure all of you are very familiar with the newspaper everyday showing cases of people that had been cheated. I would like to share with you all some tactics used by the cheater due to the seriousness of the situation.

Today I received an e-mail informing me that my account had been locked. This is not the first time I receive such e-mail. I had deleted many such e-mails. The last one claimed it was from Maybank! The e-mail was sent to my spam mail box. The cheater was hoping that I would respond to the email. I am not sure what happened if I click the link.

One thing I know is the e-mail is trying to get information about my bank account. However, just a glance at the e-mail tell me that this e-mail is sent by cheater!

First, the e-mail is sent using some stupid aezz@aol.com mail address. What stupid company will use such stupid e-mail. The cheater think he is very smart and even put up the Public Bank logo. However, he FORGOT to change the word "Maybank" to "Public Bank" at numerous places in the content.

So BEWARE if you receive this kind of e-mail. Please double check with the bank first before clicking any link. With careful observation you may even know that the e-mail is FAKE! In fact ALMOST all of such e-mail is FAKE! Banks seldom use e-mail to communicate to customer.

However, I am worry about some insider job regarding the e-mail. I had no idea where the link will direct me but I am very afraid if just giving even the slightest information will put my whole account at risk. Insider at banker combine with some info of your bank account will cost you your whole life saving money!

Well, I don't know how to stop this kind of thing from keep coming to my mail box. In fact, I got no idea how the cheater got my e-mail in the first place. That is what worry me the most. Well, after all we are in a place where anything can happen!

Saturday, March 5, 2011

Euro Rallies Most in Six Weeks on Prospects for ECB Rate Boost

March 5 (Bloomberg) -- The euro climbed the most versus the dollar in six weeks as the European Central Bank said it may raise interest rates next month, while Federal Reserve officials signaled the U.S. economy still needs stimulus.

The Swiss franc rose to a record against the U.S. currency as turmoil pushed oil to a 29-month high. The greenback fell versus most major peers on speculation a payrolls gain wasn’t enough to spur the Fed to raise rates soon. Fed Chairman Ben S. Bernanke wouldn’t rule out more Treasury buys to support growth. U.S. retail sales rose last month, data next week may show.

“The takeaway from a very busy week is still a clear tightening signal from the ECB, relatively dovish comments from Bernanke and a U.S. jobs report that’s positive, but not positive enough to alter U.S. rate expectations,” said Vassili Serebriakov, a currency strategist at Wells Fargo & Co. in New York. “There’s scope for some further near-term dollar weakness or euro strength.”

Read more at http://noir.bloomberg.com/apps/news?pid=20601087&sid=a.Gh4czpXG2Q&pos=7

The Swiss franc rose to a record against the U.S. currency as turmoil pushed oil to a 29-month high. The greenback fell versus most major peers on speculation a payrolls gain wasn’t enough to spur the Fed to raise rates soon. Fed Chairman Ben S. Bernanke wouldn’t rule out more Treasury buys to support growth. U.S. retail sales rose last month, data next week may show.

“The takeaway from a very busy week is still a clear tightening signal from the ECB, relatively dovish comments from Bernanke and a U.S. jobs report that’s positive, but not positive enough to alter U.S. rate expectations,” said Vassili Serebriakov, a currency strategist at Wells Fargo & Co. in New York. “There’s scope for some further near-term dollar weakness or euro strength.”

Read more at http://noir.bloomberg.com/apps/news?pid=20601087&sid=a.Gh4czpXG2Q&pos=7

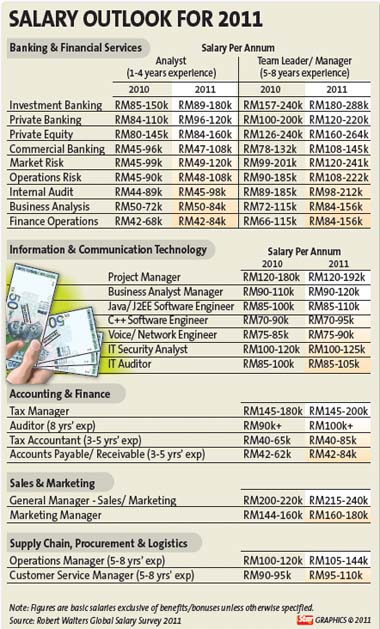

Banking salary set to rise!!!

This is the table put out on the Star online newspaper with the title 'Professionals and top execs set for huge increments' on 28 Feb 2011 at http://thestar.com.my/news/story.asp?file=%2F2011%2F2%2F28%2Fnation%2F8151490&sec=nation

So how do one react to this article? This mean the Banking and IT sector will have some big growth this year. After all, why are they willing to hired.

The weird thing about this is after just 1 day, there are some respond to the article with a contradict finding. Below are a part of the news taken from The Star Online at http://thestar.com.my/news/story.asp?file=/2011/3/1/nation/8158478&sec=nation

"A group of business application consultants from an international firm said they were surprised that their professional wages ranged from RM100,000 to RM150,000 in the survey.

The consultants, with three to five years of work experience, said their salary only ranged from RM65,000 to RM110,000 for 2010.

“There is a huge gap between the actual and surveyed figures,” said one of them who wished to be known only as Sue."

Are the salary really that high? Of course it is high! After all, it is done by Robert Walters. A quick search at the Google review the website at http://www.robertwalters.com/default.do. The website show that Robert Walters have a lot of office spanning 20 countries. This mean that it is some big international company with good reputation doing some big research.

So how come there are still some employees with low income? The answer is because they are being underpaid by the company. For the group of business consultants, I hope that they are now starting to look for a better job at another company. If not, they are just being ignorant of the market movement nowadays and lose out the big amount of money that they are supposed to be paid.

Thursday, February 17, 2011

ATIC IS BACK!

ASIA TRADER & INVESTOR CONVENTION (ATIC) IS COMING SOON! The annual event that will be held for the 5th times at the Kuala Lumpur Convention Centre from 2 – 3 April 2011. For those who do not know, ATIC is an exciting platform for Asia’s local investors and traders to gather in selected cities to learn and be educated about the latest products and services offered by local and international exchanges, brokerage firms, information service vendors and other financial service providers.

Having attended the ATIC last year, I will say the ATIC last year was a successful event. At the registering counter outside, I was given many brochure and some financial magazine (of course, not the lastest edition). There were very large crowd turnout. There were a few workshops that were conducted at the same times. So one will definitely had to choose which workshop to attend as a person cannot be at two places at the same time.

After checking the programs schedule this year, I noticed that the number of programs had been reduced significantly. Maybe that will solve the headache of choosing which workshop to attend. I cannot help but also that the number of speaker also reduced significantly. High profile speaker such as Alan Hull, Brent Penfold, Don Schellenberg and a few more seem to be missing from the list. Seem to me the event were popular with the crowd but not with the speakers. If you are interested to learn more, I suggest that you should attend the ATIC this year. There is no telling what the ATIC next year will be......

So let check the speakers list for ATIC 2011. This time the remarkable speakers feature Daryl Guppy, Alan Oliver, Jim Berg, Benny Lee, Dar Wong, G M Teoh, Gavin Tee, Mark Laudi, Dr. Nazri Khan, Fred KH Tam and Ho Chin Soon. Ticket for workshop will be available from the prices of RM70 to RM200. However, there will be early bird special discount prices if ticket are bought before 2011-03-15. For those interested, buy your ticket now!

For more information, go to ATIC official website at http://www.theatic.net/

Having attended the ATIC last year, I will say the ATIC last year was a successful event. At the registering counter outside, I was given many brochure and some financial magazine (of course, not the lastest edition). There were very large crowd turnout. There were a few workshops that were conducted at the same times. So one will definitely had to choose which workshop to attend as a person cannot be at two places at the same time.

After checking the programs schedule this year, I noticed that the number of programs had been reduced significantly. Maybe that will solve the headache of choosing which workshop to attend. I cannot help but also that the number of speaker also reduced significantly. High profile speaker such as Alan Hull, Brent Penfold, Don Schellenberg and a few more seem to be missing from the list. Seem to me the event were popular with the crowd but not with the speakers. If you are interested to learn more, I suggest that you should attend the ATIC this year. There is no telling what the ATIC next year will be......

So let check the speakers list for ATIC 2011. This time the remarkable speakers feature Daryl Guppy, Alan Oliver, Jim Berg, Benny Lee, Dar Wong, G M Teoh, Gavin Tee, Mark Laudi, Dr. Nazri Khan, Fred KH Tam and Ho Chin Soon. Ticket for workshop will be available from the prices of RM70 to RM200. However, there will be early bird special discount prices if ticket are bought before 2011-03-15. For those interested, buy your ticket now!

For more information, go to ATIC official website at http://www.theatic.net/

Subscribe to:

Comments (Atom)